Resources

Contact Form

If you would like a free consultation, please fill out our contact form or call our office at 541-486-5464.

1

Oregon Insurance Commission

Oregon has a regulatory agency specifically charged with protecting people who are not being treated correctly by insurance. On behalf of the insurance buying public the Oregon Division of Financial Regulation provides services to help ensure insurance companies treat insurance buyers properly. They can't provide the services of an attorney but they have useful information related to auto insurance here and even have an online complaint system located here

2

Oregon DMV Traffic Collision and Insurance Report

ORS 811.720 requires that you file a report with DMV:

(a) within 72 hours if you are a driver pursuant to ORS 811.725,

(b) as soon as you learn of the accident if you are the owner of the vehicle pursuant to ORS 811.730,

(c) If you are a passenger pursuant to ORS 811.735 if the driver is physically incapable of making the report.

This requirement kicks in if:

(a) Damage to your vehicle was over $2,500,

(b) Damage to property other than a vehicle was over $2,500,

(c) Your vehicle was towed from the scene as a result of damages,

(d) You or passengers in your vehicle were injured.

If you need to fill out a report, just follow this link:

3

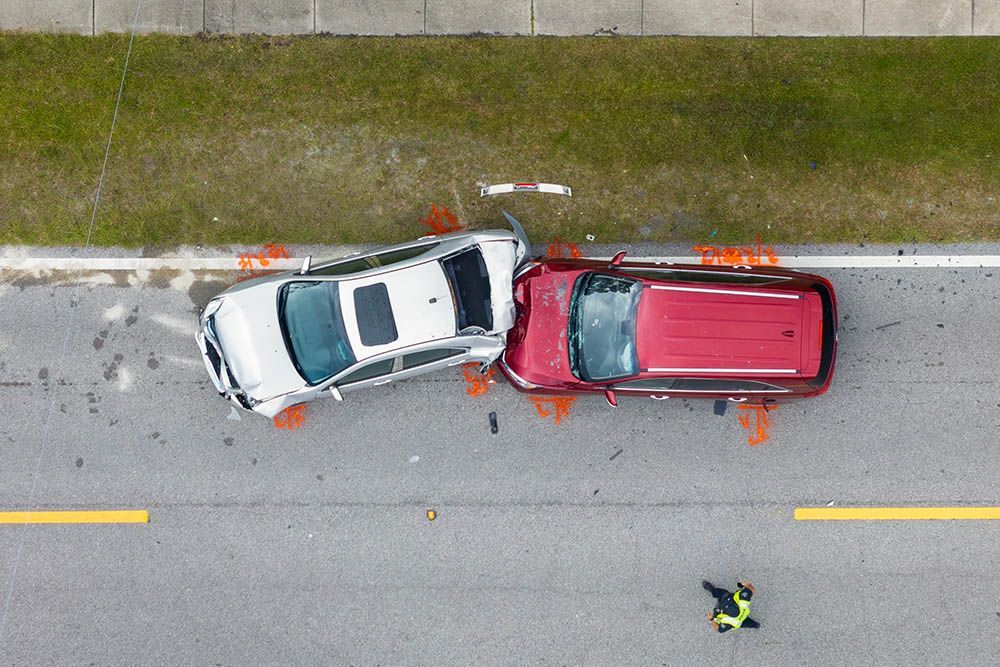

Oregon Drivers: Know What to Do After a Crash

Car accidents can happen anywhere-on city streets, highways, or rural roads. No matter the severity, what you do in the moments after a crash matters. That's why we've created a simple, step-by-step Post-Crash Checklist to help you stay safe, protect your rights, and gather critical information.

What the Checklist Covers

- Immediate safety and injury checks

- What info to collect from others at the scene

- Tips for photos, documentation, and next steps

- Why medical care and legal advice matter

- When and how to notify your insurance

Keep it in your glovebox-you'll be glad you have it. Download the Post-Crash Checklist

Need Help After an Accident?

If you've been in a crash and need legal guidance, Hunking Law, LLC is here for you. We help Oregon drivers get clarity and fight for fair compensation. With offices in Corvallis, Albany, and Eugene-we're local, experienced, and ready to help.

4

The Road to Compensation: Your Car Crash Legal Guide

Click here to download an infographic describing the legal process in Oregon from a car crash through to resolution and compensation. Follow the road to learn about each stop along the way and common terms you may encounter throughout your case. We hope that this is a helpful resource for all!

Disclaimer: Download and use of this resource does not create an attorney-client relationship with Hunking Law. If you are in Oregon and are interested in a free consultation, give us a call or contact us using the link above.